This story was originally published on Nov. 30, 2010, and is brought to you today as part of our Best of ECT News series.

As the adoption of social media is growing astronomically, it is clearly becoming the next-gen customer engagement channel of choice for industry. The banking industry is likely to be the frontier in adopting next-gen technologies, including social-networking-enabled business processes.

The banking industry has two important classifications based on customer-type: retail banking and corporate banking. Since social media has become heterogeneous of late, focusing on various customer segments, it is a strategic imperative to understand how it can be utilized to derive maximum benefit both for retail and corporate banking.

This two-part feature looks at some sample product/service offerings in the market that are targeted toward these customer groups and applies the generic buyer behavior decision stages to them.

For each stage, the different features of social media that could be leveraged will be highlighted and then a relative usage of the feature to both the customer types will be deduced based on factors like differences in product/service offerings and consumer behavior attributes.

Making Improvements

Social media is definitely making inroads into the corridors of financial institutions. Many big giants are already making their presence felt on social platforms like Facebook, Twitter and YouTube.

Based on a close look at the conversations, posts and statements the banks are making through these channels, social media can best be described as yet another channel through which information can be shared in a two-way manner.

There are some leading banks that are actually leveraging the channels in the best-possible manner, but there is still a lot of room for leveraging social media in a more sustainable way.

Finding the Right Fit

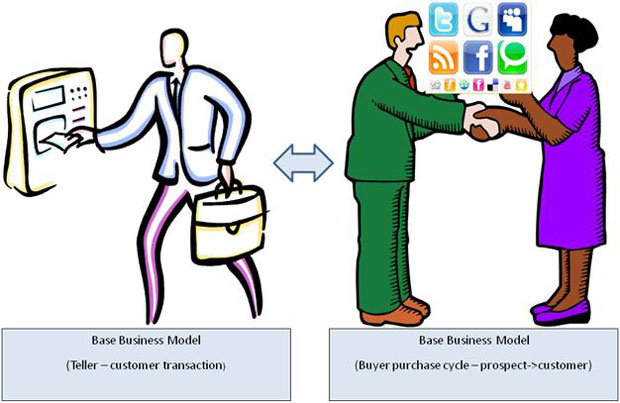

When the question concerns how to mold new avenues in an ‘As-Is’ process for the organization, a good approach is to test them on existing business models. Here, the model fit would depend on the application of the avenues.

For instance, technology (avenue) brought facility of ATMs (application) in the financial domain with bank-customer transactions being the business model.

Similarly, the way forward for sustainable functioning of social media is to identify where its applications fit into existing business models. If one rewinds and looks at the popular marketing models, the buying decision stages under consumer behavior have had lot of applicability in the practical scenarios. However, as different industries are governed by myriad factors, more relevant models must have been brought into action with the original model underlying them.

The traditional 4P’s/7P’s of marketing have been applied at various stages of the buying decision. Social media can be viewed a new communication channel and thus fulfills the ‘Place’ part of the marketing. So, we can see an already established fit of social media with buying decision stages. Beyond that, social media has a broader scope that will be highlighted in this article as the different buying stages are explored.

Matching Capabilities

Given the current usage of social media by banks and other financial companies, another aspect to look at is the heterogeneous nature of social media applications. Each has different capabilities. Similarly, heterogeneity is also very clear in the financial arena, for example, in retail and corporate banking.

While retail targets consumers, corporate targets business groups. Even in corporate banking, though, customized retail products are sometimes targeted to a company as benefits for its employees. This is an overlap, but it stills maps very well to corporate banking because it requires selling at the business group level.

Thus for sustainable usage of social media, having a logical relationship established between the avenues (social media), the applications (wikis, RSS feeds, blogs, micro-blogs and others) and the business model (buying decision stages) has to be worked out. One approach can be to leverage the applications in a way that complements the capabilities with the traits of the banking customer.

Customers and Associated Products

Let’s look at two products offered by the hypothetical ABC Bank — one a credit card under retail banking and the other a business credit card for corporations to provide to their employees. This scenario is apt because there is very thin line between the two offerings.

The end-users for both cards are individuals; still, what makes both end-users different is that in the first case the end-user will have a key role to play in the buying decision cycle, whereas in the latter, not much is in the hands of the user because the card is provided by the employer.

Stage 1: Need Recognition

The first stage concerns the way a customer identifies a potential need that is not being fulfilled by any of the available solutions in the market.

A good marketer has to be proactive and influential in creating a need in the customer’s mind. Social media provides applications that can be used to reach out to customers.

Corporate banking customers would derive their needs from amalgamation of various tracks: travel forecasts, relationships with existing vendors, approved budgets and the like. Here, the financial institutions (FI) can use social media applications like corporate product communities or virtual summits to showcase their offerings to focused groups. These applications provide features that can easily be modeled on its counterparts.

For retail customers, FI should reach out by using a variety of channels. Online marketing and advertising tools have already been available for quite some time; now, the same attention should be focused on social media platforms. The analysis of various social media platforms can help in effective segmentation and targeting of FI products and services.

Part 2 of this series will examine the different features of social media that could be leveraged at the remaining stages of the customer buying process: information search, evaluation of alternatives, purchase, and post-purchase evaluation.

Sustainable Social Media Strategies for Retail and Corporate Banking, Part 2

Social CRM

See all Social CRM