For the upcoming study, “The 2009 SFA Report: Best-in-Class Strategies for Increasing Returns on SFA Investments,” Aberdeen surveyed over 195 companies that are automating sales activity. In the research, Salesforce.com featured prominently as a solution provider of choice. In fact, 74 percent of the 50 Salesforce.com users who completed the survey are satisfied with the effect the solution has had on sales productivity, compared to 41 percent of respondents using other sales force automation (SFA) or customer relationship management (CRM) solutions.

This article examines the strategies and performance of Salesforce.com customers and provides recommendations for end-user organizations that are evaluating Salesforce.com as a solution provider.

Business Context

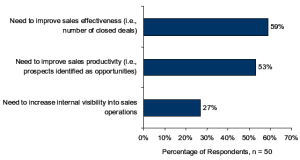

According to early findings, 59 percent of survey respondents believe the need to improve sales effectiveness (i.e., the number of closed deals) is a top-two business pressure causing the organization to devote resources towards a SFA initiative (Figure 1).

Closely related to this challenge is the need to improve sales productivity. Fifty-three percent of respondents believe that increasing the number of prospects or leads identified as opportunities in the sales pipeline is also a top-two business challenge. Naturally, in any selling environment, and particularly during a slumping economy, the need to increase the productivity and effectiveness of the sales staff is a concern for organizations.

The third pressure identified (the need for improved visibility), however, speaks directly to the challenges of user adoption.

Twenty-seven percent of survey respondents need to increase internal visibility into sales operations. Increased visibility, accurate forecasting, and comprehensive reporting, however, are often impossible without the widespread adoption of a SFA or CRM tool by the sales force. While companies may consider sales effectiveness (i.e., the number of closed deals) and sales productivity (i.e., the number of leads / prospects identified as opportunities in the sales pipeline) to be primary pressures, alleviating these challenges is extremely difficult without complete and accurate contact, account and opportunity information within the system of record for customer contact.

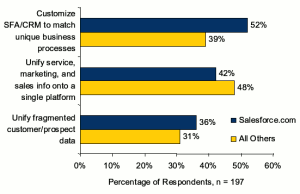

In order to alleviate specific business challenges, organizations must take a strategic approach to industry pressures. Figure 2 represents the top three strategic actions identified by Salesforce.com users and all other companies (all others). The ability to customize (without programming) the SFA to match unique business processes (43 percent) and unify customer service, marketing, and sales information onto a single platform (46 percent) are key components of Salesforce.com offerings; therefore, they are integral components of user strategies. Salesforce.com is an attractive option for end-users because it can be customized, or configured, without changing the underlying code of the application, which makes it a less daunting task for organizations. The ability for organizations to configure the solution without deep-rooted programming knowledge is a contributing factor to the 74 percent satisfaction level amongst Salesforce.com customers.

Vendor Snapshot

Established in 1999 by several former Oracle executives, Salesforce.com has grown to support more than 51,000 customers and annual revenue over US$1 billion. The company’s strengths include a legacy of strong sales force automation, partner channel management capabilities, and an expanding portfolio focusing on sales, marketing and service. Salesforce.com has evangelized the SaaS (Software as a Service) model, initially gaining traction in the market as an easy-to-use, easy-to-integrate, easy-to-customize sales force automation tool. However, over the past five years, Salesforce.com has developed an impressive set of cloud-based tools that deliver everything from Platform-as-a-Service to marketing automation. In 2008, Salesforce.com acquired InStranet, an on-premise knowledge management provider, one of the few acquisitions in the company’s history. The tool was used to increase the service and support capabilities in Salesforce.com, further expanding Salesforce.com to be an on-demand CRM player and not just on-demand sales force automation.

Salesforce.com has significant traction in the small business (less than $50 million) and midsize markets ($50 million to $1 billion). The company, which is headquartered in San Francisco, Calif., has a global presence, with clients in North America, Europe, Japan and the Asia Pacific region.

Organizational Capabilities

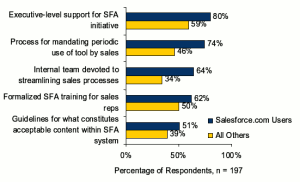

Aberdeen research reveals that Salesforce.com users are more likely than all others to implement key organizational capabilities pertaining to a SFA initiative. As a result of these organizational competencies, Salesforce.com users are better prepared at the foundational level to manage the success of a SFA initiative, thereby leading to increased levels of satisfaction at productivity gains. Figure 3 displays the organizational capabilities Salesforce.com users implement to ensure comprehensive employee adoption and the creation of an accurate system of record for prospect and customer contacts. Organizational capabilities such as executive sponsorship and formalized SFA training ensure that Salesforce.com users are able to drive an organization towards using the SFA tool correctly and comprehensively.

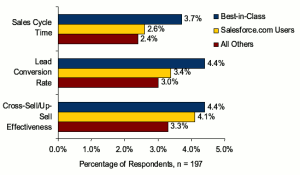

As a result of blending key strategic actions with certain organizational competencies, Salesforce.com customers are achieving higher yearly improvements compared to all others. Figure 4 reveals that Salesforce.com customers are averaging better year-over-year performance improvements compared to all others; however, Salesforce.com users still trail Best-in-Class performers.

You Can’t Manage What You Don’t Measure

Prior to the implementation of any technology solution, organizations must determine the metrics that it hopes to affect through the initiative. Currently, 42 percent of Salesforce.com users, compared to 31 percent of all others, have defined metrics to measure the effect of a SFA solution on Key Performance Indicators (KPIs). By gathering key stakeholders and outlining the measurements of success, organizations can ensure more meaningful conversations with vendors as they move through the evaluation process.

Figure 4 reveals that Salesforce.com users are averaging higher levels of improvement compared to all others. Of course, the ability for an organization to improve in key metrics is dependent upon its ability to define what metrics matter to the organization and track them over time. Figure 4 displays that an organizational focus on important metrics, coupled with the proper processes, results in year-over-year improvements.

Key Takeaways

Prospective buyers of Salesforce.com solutions should keep the following points in mind when performing their due diligence:

- Content is king. A SFA tool is only as valuable as the information that populates it. Whether an organization mandates the use of its SFA tool or simply promotes it through the integration of key sales information from third-party providers, such as Jigsaw or InsideView, the ultimate goal is to build a repository of complete and accurate contact, account, and opportunity information. Organizations must be sure to implement guidelines for what constitutes proper and acceptable content within the SFA / CRM tool, regardless of how the content is entered into the system. Salesforce.com customers are more likely than all others to implement the organizational capabilities that promote employee adoption and data input (Figure 3). The result for Salesforce.com customers is an improved performance in key sales metrics.

- Define and track key metrics. Currently, 46 percent of Best-in-Class companies, compared to 31 percent of all others, have defined sales performance metrics in place to measure performance. Prior to the implementation of a SFA or CRM vendor, organizations must assemble key stakeholders within the organization and decide upon which metrics are most indicative of success to the company. Once these metrics have been defined, it is up to the organization to track them over time and determine the effect that technology has on sales effectiveness.

- Reinforce desired behaviors throughout the organization. The success or failure of an initiative often depends on how well the company’s leadership can promote the benefits internally and model desired behavior. This is particularly true in terms of employee adoption of SFA or CRM tools. Executive-leadership must drive the organization to use a tool and provide the necessary training to employees. Current Salesforce.com users are 1.4 times more likely than all others to provide this level of organizational support for SFA or CRM initiatives; as a result, they are experiencing heightened levels of success.

Alex Jefferies is a senior research associate for Aberdeen Group’s customer management technologies group.

Social CRM

See all Social CRM