Companies seeking to organize and centralize customer, account and opportunity information are leveraging sales force automation (SFA) and customer relationship management (CRM) tools to provide sales managers with better visibility into internal operations and improve overall sales productivity. Despite the proposed benefits of an SFA/CRM initiative, some companies are still not realizing the sales potential of their SFA/CRM solutions due to inefficient processes and incomplete employee adoption.

The early findings from the upcoming Aberdeen benchmark, “The 2009 SFA Report: Best-in-Class Strategies for Increasing Returns on SFA Investments,” reveal that 34 percent of end-users surveyed are unsatisfied with the effect their SFA tool has on sales productivity; in fact, only 10 percent of 203 survey respondents are “extremely satisfied” with their current SFA initiative. This article examines two popular methods of sparking employee adoption of sales automation tools and the effect each method has on sales performance.

Business Context

According to early findings, 61 percent of survey respondents believe the need to improve sales effectiveness (i.e., the number of closed deals) is a top-two business pressure causing the organization to devote resources toward an SFA initiative. Closely related to this challenge is the need to improve sales productivity. Fifty-two percent of respondents believe that increasing the number of prospects or leads identified as opportunities in the sales pipeline is also a top-two business challenge.

Naturally, in any selling environment, and particularly during a slumping economy, the need to increase the productivity and effectiveness of the sales staff is a concern for organizations. The third pressure identified (the need for improved visibility), however, speaks directly to the challenges of user adoption.

Twenty-seven percent of survey respondents need to increase internal visibility into sales operations. Increased visibility, accurate forecasting, and comprehensive reporting, however, are often impossible without the widespread adoption of an SFA or CRM tool by the sales force. While companies may consider sales effectiveness (i.e., the number of closed deals) and sales productivity (i.e., the number of leads/prospects identified as opportunities in the sales pipeline) to be primary pressures, alleviating these challenges is extremely difficult without complete and accurate contact, account, and opportunity information within the system of record for customer contact. In order to achieve this higher level of internal visibility, organizations are choosing between two common methods for sparking employee adoption of existing sales tools.

The Carrot Method

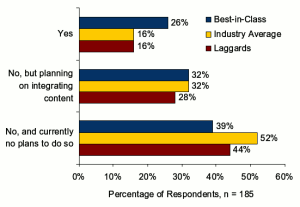

When it comes to the user adoption of existing SFA or CRM tools, organizations find they typically have two methods of choice: the carrot or the stick. The “carrot” method finds companies proving out the value of SFA/CRM to sales reps by making the content they crave available directly within the tool, such as basic contact information, company information, corporate hierarchies, and segmented contacts compiled using the characteristics of profitable customers (Figure 1). By reducing the amount of time reps spend searching for relevant account information online, organizations are able to help their reps maximize their selling time. By integrating key sales information (Table 1) from third-party providers — such as ZoomInfo, SalesGenie.com, or Jigsaw — directly into the SFA/CRM tool, reps are able to spend more time using the solution, making targeted and meaningful dials, and inputting call histories.

Table 1: Common Sales Intelligence Data Currently in Use

Types of Sales Intelligence Definitions Percentage of Survey Respondents Currently Using within Sales Basic ‘business card’ information Information such as name, phone number, title, and email address 65% Basic company information Information such as location, annual revenue earnings, headcount, and credit reports 59% Company hierarchy Information such as executive/managerial roles and the ‘general pecking order’ 43% ‘Segmented’ contacts Information on companies that fit a certain predetermined criteria, such a geographical location, business model, revenue size, or other characteristics shared with the ‘ideal’ prospect 36% Competitive intelligence Information on closest competitors, such as product announcements, leadership changes, or office openings 33%

Figure 1 reveals that Best-in-Class companies are 1.6 times more likely than all others to integrate key sales intelligence, such as competitive intelligence and company information, directly into an existing SFA or CRM solution.

Furthermore, the eventual adoption rate of 58 percent amongst Best-in-Class outpaces the 48 percent of Industry Average and 44 percent of Laggards who plan to integrate key sales information into SFA or CRM. The use of third-party information is a key component of a “carrot” strategy.

Organizations hopeful to spark employee adoption of SFA/CRM tools must be able to display the value of tools by proving that the information contained therein leads to closed deals and higher commissions. Once sales reps are able to reduce the amount of time spent searching for relevant information and increase their productivity, the theory is that they’ll continue to use the SFA/CRM to achieve further gains.

The Stick Method

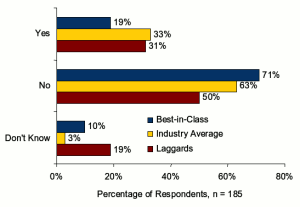

Some companies opt to mandate the use of existing tools. The ‘stick’ method finds companies mandating SFA or CRM adoption and usage by linking SFA or CRM activity to performance reviews, commission payouts and bonuses.

For example, some companies will not pay out the commission on a sale unless the rep has successfully moved the opportunity through all the predetermined phases in the SFA or CRM prior to marking it “Closed-Won.”

While this method is somewhat successful in getting reps to use the solutions, it can possibly have a negative effect on sales culture and how employees view the organization.

Figure 2 reveals that a higher percentage of Industry Average and Laggard organizations enforce the use of an existing SFA/CRM tool with penalties rather than incentives (i.e. a “stick”) compared to the Best-in-Class.

As Aberdeen research reveals, this preferred method amongst the Industry Average and Laggards may be a contributing factor to their (lack of) performance.

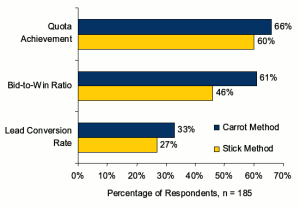

Figure 3 reveals that companies using the “carrot method” (i.e., providing value through the SFA/CRM tool to spark adoption) are performing better in key sales metrics compared to those who opt for the “stick” method (i.e., mandating the use of a tool).

The correlation suggests that organizations that enable reps to access the data they need within an SFA or CRM solution are reducing the amount of time spent searching for relevant material and increasing both sales productivity and effectiveness.

Recommended Actions

Organizations evaluating SFA/CRM solution providers or those examining ways to increase the returns from their ongoing initiative should consider the following points.

- Develop a Plan for User Adoption. Companies struggling to determine the ROI of their SFA/CRM investment are often challenged with incomplete user adoption. After all, companies are still waging the age-old battle with sales representatives about who owns contact assets and prospect lists. When deciding between the “carrot or the stick” method to spark employee adoption, companies must take several factors into account, such as organizational resources, company culture, and SFA/CRM training. Once a company has decided on a course of action to spur employee use of an existing SFA/CRM tool, the next step is to be patient. Fifty-five percent of survey respondents believe it takes more than a year to realize the return on an SFA/CRM investment. For this reason, end-user businesses must perform their due diligence and take into account several organizational-specific elements before deciding on a course of action.

- Content Is King. An SFA/CRM tool is only as valuable as the information that populates it. Whether an organization mandates the use of its SFA/CRM tool or simply promotes it through the integration of key sales information, the ultimate goal is to build a repository of complete and accurate contact, account and opportunity information. Organizations must be sure to implement guidelines for what constitutes proper and acceptable content within the SFA/CRM tool, regardless of how the content is entered into the system.

- Customize. No two businesses operate exactly the same; therefore, companies must be able to customize their SFA/CRM tool to match unique business processes. Whether it be report customization or information management, customization initiatives allow organizations to improve the effectives of an existing SFA/CRM solution by making it easier for a user to receive the information they require.

There are a number of factors that contribute to the success (or failure) of an SFA/CRM initiative: employee adoption, solution training, organizational resources and processes, and the content contained within. Oftentimes, these challenges are more pronounced by Software as a Service (SaaS) solutions; after all, it is so easy and quick to get a SaaS solution up and running that companies often sacrifice the necessary planning beforehand. Those companies evaluating SFA, CRM, or sales intelligence providers must be sure to refine organizational expectations and processes to ensure a higher return from investment.

Alex Jefferies is a senior research associate for Aberdeen Group’s customer management technologies group.