Dreamforce for many years has been too big for a single person to cover. While I participate in covering events like this, inevitably I am reduced to the story of the three blind people and the elephant. You can’t experience enough of the elephant to describe it unless you can see it. Using your hands leaves you frustrated. In the case of Dreamforce, you can’t go to all of the sessions.

My overall idea of the show this year: It was yuge, and for the first time it was not about technology per se, and that’s a good thing.

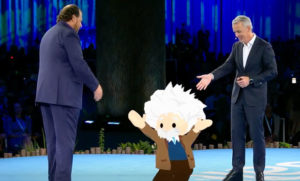

Salesforce announced its new AI offering, Einstein, two weeks before the show, so the announcements turned out to be anticlimactic. I had held out hope that if they were announcing Einstein early, then there would be something even bigger to report on — but there wasn’t.

That’s fine, because — alluding to elephants again — the company will have a lot to chew on for a while.

Developers in Demand

For me, the essence of the show has turned to what people are doing with the plethora of technologies, clouds and services that already have been delivered. There was plenty to talk about around the three pillars of CRM — sales, marketing and service — and even beyond Einstein, there were things like IoT that got a lot of attention.

A walk on the show floors told me two things were important beyond everything else: developer enablement and partner enablement. As the company blows past US$8 billion in annual revenue, the idea of enablement will become even more central to its growth plans, and that’s why it needs more partners and developers.

For developers, Dreamforce had a show within a show at Moscone West, where all things Trailhead were on display. Trailhead is the program reaching out to people who want to learn development with the product toolsets, and Salesforce hopes to train many tens of thousands of developers and admins.

There are more than 350,000 jobs open for qualified developers and admins of varying skill levels, according to one source at the show.

So Trailhead provided on-site teaching and hands-on sessions in the hope that some of the attendees would go home and hone their skills. The Trailhead DX event in May was very popular, and I expect its success drove the investment at Dreamforce. Trailhead at Dreamforce was mobbed.

A Plethora of Partners

On the other side of the equation, partners were ubiquitous. The main floor was covered with ecosystem partners hoping to garner leads, and they succeeded. However, building an interesting product is not the same as being successful.

I saw many products that I’d have to say were of questionable business value. They were concentrated in the three main CRM stovepipes, and it seems to me they were working too hard to cover spaces that already have been well covered.

What I found most interesting were the new and interesting things partners are doing outside of CRM — and often the partners were large Fortune 500 companies with names like GM and Eli Lilly. Even in this high-innovation area, there is some reason for skepticism, however.

GM is working hard to develop a follow-on product to its Nstar customer connection application. In its initial conception, Nstar was a service to help in an emergency — an accident or something ailing in the car. The new concept is to turn the car into a computer on wheels, so that occupants can interact with the world at all times. Finding a dry cleaner or fast food restaurant while driving are typical examples, as is communicating with the world in general.

My critique of this approach is not about the technology but about the business model. It looks like the approach to making money with this new app is through selling advertising — a tried-and-true but limited model.

Even when integrated directly with the car and driver, this solution does little more than what anyone could do with a smartphone — though probably not while driving. Since most of our drives are within miles of home, it’s reasonable to believe that we already know where to find pizza and cleaners, so the use case hasn’t been made in my mind.

The Post-Advertising Model

This raises the important point that the whole industry is in search of a business model that goes beyond advertising. There are more channels for selling ads than we need at the moment, and it strikes me that we’re approaching saturation in channels, services and devices.

The industry needs to figure out a new business model for the IoT devices intended to do something involving customers. I know there is a better use case not involving advertising — but what is it? We should run a contest.

In my mind, the show had the possible Twitter acquisition hanging over it. CEO Marc Benioff met with investors and financial press to discuss his approach to acquisitions, and to indirectly address the rumor that he wanted to buy Twitter. The issue I see is that Twitter is nice to have but not essential, and it seems to have plateaued at 300-plus million users. It also has $3.6 billion in assets and $1.6 billion in liabilities. Not bad.

Twitter has some great technology, as do Facebook and LinkedIn, and you can understand this just in looking at the number of users active at any one time — but how does Twitter make money? It seems the only social network that’s killing it is Facebook.

On a different level, I was impressed with all things healthcare-related at Dreamforce. I see the healthcare industry as primed for disruption. It’s a walled garden with very expensive products that are expensive only because of the barriers.

Fixing healthcare IT and helping to reduce the high costs could be the No. 1 or 2 issue facing the industry. Salesforce and its partners (like Vlocity and Veeva) are building solutions that will be used to surround and eventually eliminate systems that can be 40 years old or more.

The disruption will look a lot like what’s been going on in ERP lately. Cloud ERP finally has reached a tipping point, with companies like Financial Force leading. Of course, there’s also NetSuite, a public company for which Oracle has made a $9.3 billion bid.

Cloud ERP providers have been executing a surround strategy for several years, and their efforts are bearing fruit. I think the healthcare software providers ought to pay attention. It will take a decade, but the next disruption is in healthcare. Just wait.