Gulf Cooperation Council (GCC) banks have begun to feel the heat of competitive pressure from foreign banks that are trying to exploit the potential investment prospects in this market by riding on their vast experience and proven consumer-friendly services. In such a scenario, the banks have nothing to blame but their laid-back approach and less-than-stellar commitment to customer service, leading to lower satisfaction and higher churn.

Already reeling from the recent economic downturn, defection of dissatisfied customers may well be the last nail in their coffin. So how to save the day? Committed investments in CRM technology may just do the trick, as it will provide a cost-effective way of covering all customer touchpoints and tightly integrating them with sales. Such investments will also boost the effectiveness of service agents, who would know their customers better and be better equipped to serve them well.

Banking among the GCC nations boasts 8 percent growth (double the growth rate of GDP) with a mind-numbing asset base of more than AED5,000 billion. This is contributed by the region’s banking population of just 17 million who have upwards of US$30,000 as average disposable income.

Considering the fact that more than 50 banks, both local and foreign, compete for the stagnant market pie, it is imperative to build up a differentiating factor — and customer service would just fill the bill.

What’s Bothering the Customers?

Customer service can easily make or break a business. Unfortunately, in the Middle-East, it leaves a lot to be addressed. Customer delight is a farfetched dream for retail banking customers of GCC banks, where customer satisfaction has hit an all-time low. The various causes of low customer satisfaction levels can be attributed to the following:Absence of knowledgeable staff: Almost 62 percent of banking customers are most annoyed due to the limited knowledge the touchpoint staff has to offer. Customers fail to get desired information on product breadth and holdings, transaction details and product features. The staff faces the daunting task of referring to myriad applications to delineate a holistic picture of the customer’s banking history.

Sub-standard service: 51 percent of customers believe they are not getting the service quality they deserve. This is consistent across both forms of banking, Islamic as well as conventional. This is also evident in the transition process, where the nature of a customer’s relationship with the bank changes. The pain point to be addressed here is the turnaround time taken to resolve an issue and establish effective communication.

Low Response Rate: More than 43 percent of customers feel that they are not getting proper attention. The pattern is same across all nationality groups, which mainly includes expatriates. GCC banks are not responding or following up in a timely manner. Out of all the negative customer service requests raised, 33 percent are based on delayed response or no response at all. Due to gaps in tracking and monitoring procedures, a number of requests get dropped or abandoned.

Lack of multichannel synergy: Another thing contributing to customer satisfaction is the bank’s ability to synergize various channels through which customers are contacted. This lack of an end-to-end integrated, well-oiled mechanism damages cross-sell opportunities.

GCC banks take a product-centric approach rather than a customer- centric approach, resulting in lower product-per-customer ratios compared with their Western counterparts — i.e. 1:3. This leads to further annoyance and discontent among customers.

While roughly half of all GCC nationals consider their customer service experience neutral or negative, more than 90 percent of expatriates do so. This is alarming, considering the fact that GCC population comprises more than 70 percent expatriates.

On top of this, 18 percent said they were “very dissatisfied” or “dissatisfied” with their main bank — and 50 percent would not recommend their bank to a friend or colleague. Thus it comes as no surprise that 20 percent of customers were considering terminating their relationship with their main bank, amid widespread dissatisfaction and a host of common grievances.

Customers are behaving very differently post-recession. Abundance of foreign banks in the region, growing awareness, increased customer expectations and buying power, together with low switching costs, are the key concern in today’s competitive banking environment for GCC Banks.

The customers are in a propitious position as they see little difference in the offerings of different banks. They expect to receive first-rate service, and any lapse in it can lead to negative word of mouth that costs the bank dearly.

How Can CRM Add Value?

The key ingredient of a successful retail bank is its satisfied and loyal customers. Thus, banks must put together strong strategies in customer acquisition and retention in order to succeed in the long term. They need to make efforts toward enhancing their service quality in such a way that every customer’s experience with the bank results in a positive response and a sense of belonging.

In Roger Schmenner’s service process matrix, retail banking falls in the “Mass Service” quadrant, where degree of customization is low but degree of labor intensity is very high. The two most critical success factors for this sector are harmony in delivery and people management.

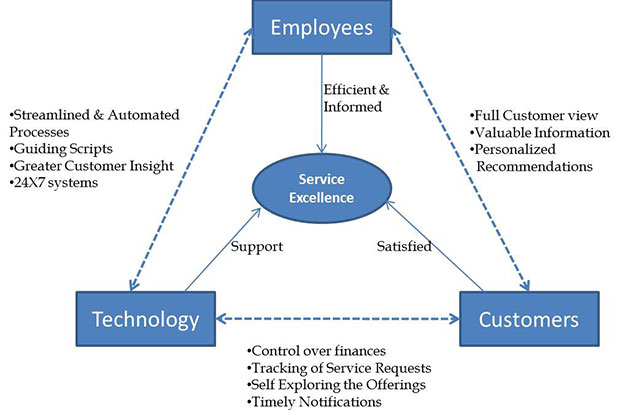

The service encounter triad indicates how technology can assist in delivering a homogeneous product-service mix to customers through well-equipped resources. The nature of interactions between employees, technologies and customers defines service quality.

CRM technology can increase employee productivity by streamlining service processes and guiding staff through each interaction type. Employees who are trained in the implemented technology and have an understanding of the banking processes will be able to provide personalized and more appropriate services to their customers.

The contact customers with technology comes through online encounters, where they can create new service requests, track the status of existing issues, view account transactions, generate bank statements, make online payments, get real-time transaction notifications, manage funds, and check new offerings, thereby giving them more control over their finances.

To achieve the above-mentioned benefits and address the concerns expressed by customers, certain transformations can be introduced in the existing enterprise architecture of GCC Banks:Customer Data Integrity: The application landscape should be designed such that each customer point-of-contact has access to real-time data with minimal effort.

A customer 360-degree feature is the need of the hour to promptly present transaction history, holdings and charges to the staff. This can be achieved through real-time enterprise application integration of multiple core banking systems containing transactional data, displaying it on CRM application as the front end.

Smart scripts or smart answers is another feature to help front-end staff in answering customer queries. They can be provided product briefs, campaign literature and use-case scenarios to interact with customers better.

Audit trail capability will empower the front-end staff to inform customers as to what changes occurred when. All the changes being made to database records will be maintained as a separate entity, along with old value, new value, date and user ID. Front-desk staff can easily communicate various charges levied, changes done to personal details, and product-related modifications to the customers.

Overwhelming Service Quality: Service approaches should be defined in such a way that customers can expect a consistent experience with minimal handling time.

Service request management: CRM supports customer interactions through various modes like self-service (online and email), call centers, front desks and field service. A devoted system that will capture the issues, complaints and concerns of customers coming in from various channels will help in effective tracking, monitoring and closure.

Various features like knowledge management, solution search capabilities, flexible request assignment, scheduling, notifications and request fulfillment are available in commercial on-the-shelf (COTS) CRM applications. Service analysis is another important attribute of CRM that can be used to measure the service quality on certain key metrics like average resolution time, first contact resolution and self-service effectiveness.

Computer telephony integration will reduce customer contact time and add a personal touch. Most CRM applications provide built-in integration (in-bound and out-bound) with popular CTI middleware for enabling intelligent queuing and call routing based upon customer profile and agent skills, automated screen pop up with customer details, call (including screen) transfers, call recording and linkage with corresponding requests, predictive dialing, and so forth.

User Notifications and alarms can be provided under a wide range of circumstances for requests that are nearing the due time, are already due or are overdue, as well as to inform the agents of any new requests that have been assigned to them. These instant alerts (email, SMS or Fax) can help managers take timely action on requests that are being handled inappropriately.

Through timely notifications to all segments, any changes to existing relationships or allocations for new relationships can be communicated effectively through activities setup and enforced follow-up mechanisms. Proactive notifications can also be sent to the customers to keep them updated by providing account transaction confirmations, service request updates, payment reminders, email newsletters and the like.

Strike when iron is hot: The best time to seize a deal is when the customer approaches you. Banks should revisit their distribution networks to ensure that each customer receives due attention, and opportunities knocking at the door are never lost.

Closed-loop marketing: Clients relying on IT applications content themselves with the responses they receive for the launched campaigns. They will actually realize the benefits of closed-loop only when they can see the conversions coming in.

In order to reach something close to the quintessential state, multiple entities should be linked with each other such that positive campaign responses result in auto-lead creation, which in turn submits an application. In this manner, no opportunities will get lost — and within five minutes of sending an email/SMS or clicking a button on an ATM machine, the customer can receive a call from a bank representative.

Customer notifications should be sent through emails or SMS updating the latest status of a request. For every response received from a customer, an auto reply should be sent confirming acceptance of the communication.

For the GCC region, Handheld devices are more of a necessity than a luxury. Relationship managers and field sales staff can access CRM applications through such devices and offer personalized services to high-net-worth individuals. During a sales pitch, they can retrieve real-time account balances, leverage values or debt exposure, and help clients make well-informed investment decisions.

Harmony among touchpoints: In order to deliver a seamless customer experience, it is critical to closely integrate all front-end interaction channels and disparate back-office applications.

Most CRM applications provide the capability to synchronize customer touchpoints across all the channels, including call center, online portals and front desk. A customer targeted through ATM, SMS or email could choose to respond by calling up or visiting the bank. If data across all the channels is unified, the front-desk staff will be able to view interactions with customers through various modes and can also capture responses.

Banks need state-of-the-art systems where the CRM application can be tightly integrated with all the other support systems, including core banking, order processing, in-bound and out-bound dialer, SMS gateway, ATMs and more. This will help improve data consistency and introduce advanced features like auto rescheduling and predictive dialing. CRM applications provide the capability to integrate back-office applications easily through their integration modules.

CRM can be used to present intelligent up-sell and cross-sell propositions to customers based upon their interactions and order histories. Features like product compatibility rules, purchase eligibility checks and related item recommendations can be used to propose real-time optimal offers.

In a Nutshell

Well evident by the recent entry of multiple foreign banks, the GCC banking sector is certainly a promising one, with lucrative growth projections. World-class service standards of foreign banks have given them the extra mileage — so far. Adopting the best practices and industry recommendations can put the GCC banks a step ahead of their foreign competitors.

Even as little as a 5 percent increase in customer retention can increase profitability by 25 percent to 85 percent. Thus, improved customer service will directly affect the bottom line and can increase the profits of a midsized GCC bank anywhere from $50 million to $150 million a year.

GCC banks should invest in both technology and resources to improve the customer experience, which willd be instrumental in delivering augmented profits. On the technology front, a robust CRM solution should be adopted that encompasses all customer touchpoints and provides real-time analytics support to front-desk staff, thereby increasing their productivity and effectiveness.

Social CRM

See all Social CRM