Brands must empower a new sense of customer engagement to meet evolving consumer expectations. Otherwise, they will fall short of business outcomes and revenue goals, according to a wide-ranging research effort.

The Braze comprehensive customer engagement platform is one tool business leaders can use to help foster a higher, more successful engagement level. The CRM system amplifies interactions between consumers and their favorite brands.

Braze recently released its second annual Customer Engagement Review that combined data from the Braze platform and the results from a global survey of more than 1,500 marketing decision-makers across 14 global markets.

The survey, conducted by Wakefield Research in the fall of 2021, unveiled macro trends that evolved within customer engagement changes last year. It highlights opportunities for improvement and growth for 2022.

The report also shows findings across five different industries — financial services, health and wellness, media and entertainment, quick service restaurant (QSR) and delivery, and retail and e-commerce. It provides regional breakouts for Asia-Pacific (APAC); Europe, the Middle East, Africa (EMEA); and the U.S.

Each industry and regional breakout features a case study from a leading Braze customer, including Public.com, PureGym, Peacock, The Coffee Club, Mercari, LinkAja, Free Now, and Bees.

The events of the past two years have fundamentally altered the way customers approach brand relationships. The bar for consumer expectations is at an all-time high, offered Bill Magnuson, co-founder and CEO of Braze.

“For brands to rise to the occasion, they must focus on establishing a personal connection through customer engagement and provide seamless communication across their preferred channels and platforms. Companies that fail to provide coordinated, cross-channel customer engagement strategies risk falling behind on business outcomes and revenue goals,” he told CRM Buyer.

Report Highlights

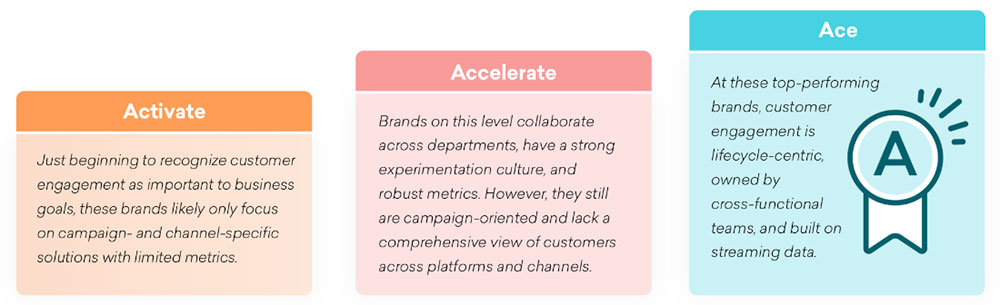

The report included Braze’s Customer Engagement Index. This is a framework assessing brands in 12 competencies across two key axes — technology and teams — to put forward a model for best-in-class customer engagement.

Each brand is then indexed on these factors and distributed across three maturity stages — Activate, Accelerate, and Ace.

The index revealed overall positive momentum from last year, with many companies increasing their maturity and sophistication across all 12 customer engagement competencies.

A few major highlights from this year’s report show:

- Retention is a top priority. This is not new as brands tended to devote more energy and marketing resources to acquisition and top-of-funnel growth. This dynamic is changing, as shown by the 30 percent increase in brands allocating 51 to 75 percent of their budget for retention compared to last year.

- Untapped potential of anonymous users, who do not log in, comprised 57 percent of new users last year. Some 80 percent of these anonymous users received no messages from brands. By engaging with these users on just one channel, brands can increase their likelihood to make a repeat purchase by 64 percent.

- Companies that leverage a cross-channel approach to customer engagement continue to see top results. Brands that combined both in-product messages and out-of-product messages increased a user’s likelihood to buy by 3.1 times compared to a single-channel approach. On average, each additional channel added to a company’s messaging mix results in 4.3 times more purchases per user and 2.8 times lift in likelihood to buy.

Spawning a New Era

The pandemic brought an irreversible new era of customer expectations. The ensuing changes fundamentally altered every aspect of our lives, including how we approach brand relationships and how we decide which of their products and services are worthy of inclusion in our lives, noted Magnuson.

“Navigating this transition is the latest customer engagement challenge for brands. Businesses around the world are rising to the occasion and continuing to gain confidence in their ability to navigate this next normal,” he wrote in the report’s introduction.

As mentioned above, a key element in the Braze report is the unique Customer Engagement Index researchers developed. This graphic details the three levels of engagement.

Source: The Braze Customer Engagement Index

These efforts are paying off. Customer engagement is improving, according to Myles Kleeger, president and chief customer officer at Braze.

“Over the last few years, many businesses have been laser-focused on digital-first or digital-only customer experiences. As many of these processes have become more established and integrated into a new normal, now there is an increased focus on investing in customer satisfaction and engagement as a whole, across channels and platforms,” he told CRM Buyer.

Marketing budgets are expected to increase this year, with an emphasis on investment in customer engagement tools. For example, according to Braze’s findings, 39 percent of U.S.-based companies are planning to increase investment in customer engagement in 2022.

“This increased budget will enable organizations to reevaluate the efficacy of spend on new acquisition and retention,” he said.

Shifting Cookie Dependence

The report highlights three key factors impacting how customers and brands morph their interactions. All three findings show that new engagement strategies are working.

First, a shift toward zero- and first-party data is continuing. That is a result, in part, of a decline in third-party cookie use. Changes in the data landscape forced brands to abandon third-party data in favor of focusing on creating impactful, relevant experiences through other means.

To accommodate these changes, 96 percent of brands plan to increase their marketing budgets. Also, 42 percent plan to boost how many channels they use, and 38 percent of companies plan to place a heavier emphasis on zero-party and first-party data in order to continue to target and engage audiences.

Data and Brand Focus

The second key engagement factor, data management, is becoming a top challenge for brands. So much, in fact, that three of the four top concerns for brands this year are all about data and how to leverage it effectively.

An increase in digital touchpoints provides businesses with valuable insights. That increase brings the companies even more data as customers interact with new and varied touchpoints.

This data is integral to meeting customers’ wants and needs. But the report found brands become overwhelmed with managing the increased data volume. Nearly one-third (32 percent) of brands ranked collecting, integrating, and managing data as a top concern for 2022.

Third, brand confidence in customer engagement abilities is growing. Along with that growth is increased revenue.

Researchers saw an increase in company confidence for customer engagement. A solid 94 percent of companies ranked their customer engagement as excellent/good compared to only 88 percent last year.

Report Conclusions

Researchers found a continuing correlation between the level of customer engagement a brand provides and revenue.

Of the companies that ranked their customer engagement as excellent/good, 98 percent exceeded their revenue targets. Of those that did not, only 65 percent met their revenue goals.

Increased volumes of data now available means turning insights into cohesive marketing strategies can be overwhelming. The report found that the primary concern (32 percent) for brands in 2022 was collecting, integrating, and managing data.

“Organizations can meet this challenge by ensuring there is streaming data and data agility across their tech stack. AI and other forms of automation can also enable marketers to operationalize data and corresponding insights to make better decisions and create more personalized experiences, ultimately delivering more business value,” Kleeger said.