The PC market ended 2020 with a big bang, as shipments during the final quarter rose 25 percent over the same period in 2019, according to a report by research firm Canalys.

Shipments of desktops, notebooks and workstations reached a record 90.3 million units during the period, the report noted.

PC shipments jumped for the third consecutive quarter during the year, with the fourth quarter showing a 13 percent increase over the previous quarter.

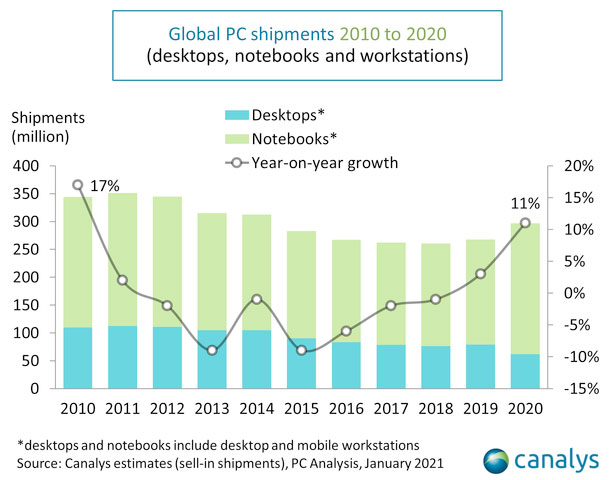

For the entire year, Canalys reported, PC shipments grew 11 percent, the highest full-year growth since 2010, and reached 297 million units, the highest shipment volume since 2014.

The report revealed that much of the market growth during the year was driven by notebooks and mobile workstation shipments, which increased 44 percent over 2019, reaching 235.1 million.

The one smudge on the rosy picture for PCs was shipments of desktops and desktop workstations. They dropped 20 percent from 2019, reaching only 61.9 million units.

“There was a lot of talk early on that this was just going to be a one quarter hit, but it has continued throughout the year,” observed Bob O’Donnell founder and chief analyst Technalysis Research.

“Everybody I’ve talked to suggests it’s going to continue well into 2021,” he told TechNewsWorld.

Death of PC Exaggerated

The death of the PC — declared in 2013, 2015, and other years — has always been a false narrative, maintained J. P. Gownder, a vice president and principal analyst at Forrester Research.

“Even though the PC market has seen ups and downs over the years, it has remained central to consumers’ and workers’ lives,” he told TechNewsWorld. “It’s been joined by tablets and, especially, smartphones, but the PC remains a bedrock technology.

“2020 showed people just how much they relied on a PC,” he added.

Rushabh Doshi, research director for mobility at Canalys, explained that the COVID-19 pandemic played a major role in the growth of the PC market.

“While businesses have woken up to the importance of having a PC that needs to be more mobile to account for black-swan events where onsite workers might have to work remotely, underlining the popularity of the notebook, consumers now understand the productivity gains from using a PC versus a tablet or smartphone, especially when it comes to remote learning,” he told TechNewsWorld.

“PCs have quickly shifted from a ‘one-per-household’ to a ‘one-per-member’ requirement, which is further fueling the demand,” he continued.

“This demand is expected to continue into 2021, with vendors focusing on ensuring stickiness in this newfound user base,” he added.

Time to Upgrade

The pandemic persuaded many people that it was time to upgrade their PCs, noted Jack E. Gold, founder and principal analyst at J.Gold Associates.

“People and companies had to go out and get machines for work at home,” he told TechNewsWorld. “In some cases it was because people had machines that were six, seven, eight years old.”

In addition, consumers who may have been holding out on refreshing their hardware may have started to see the handwriting on the wall in the fourth quarter, added Charles King, the principal analyst at Pund-IT.

“Despite the increasing availability of effective vaccines,” he told TechNewsWorld, “the surge in COVID infections and deaths suggest that working from home and distance learning will continue well into 2021.”

Another factor contributing to fourth quarter sales was availability. “There was a lot of supply constraint during the year, and some of that eased up in the fourth quarter,” Ross Rubin, the principal analyst at Reticle Research, told TechNewsWorld.

Some generational distinctions are appearing during the market surge that may be good news for future sales. “I am seeing that GenZ is using their PCs more than millennials,” Patrick Moorhead, founder and principal analyst at Moor Insights & Strategy, told TechNewsWorld. “They realize that they can get more and different things done with a keyboard and larger display.”

Gaming, Education Thrive

Two of the hottest sectors for PCs were education and gaming, noted Stephen Baker, an analyst with the NPD Group.

“Educational organizations ate every Chromebook they could get that shipped into the U.S.,” he told TechNewsWorld.

“Much of that demand hasn’t been satisfied and will go into 2021, as well,” he added.

“Gaming has been a phenomena all year,” he continued. “It’s been up much more than the overall industry since March.”

“As people looked for activities to do at home, gaming was something that people could do,” he explained.

He also noted that the Do-It-Yourself PC market grew 40 to 50 percent over the previous year. “There was an enormous rush into the market of consumers building their own PCs,” Baker said.

Bump or Slump?

As 2021 begins, the big question on market watchers’ minds is how will PC shipments do after their historic performance in 2020.

“I believe PC sales will grow in 2021,” King said. “Though I’m optimistic about the increasing availability of effective vaccines, I expect working from home and distance learning will continue through most of the year. That will help drive increasing demand for solutions that facilitate working and learning from home.”

Gold noted that people don’t buy a new PC every week, so there could be a letdown in 2021. However, he added, ” There are still hundreds of millions of five-year-old and older PCs in the marketplace that people are still using.”

“A lot of businesses that have desktop PCs in a fixed office are recognizing that the workplace is going to change so they have to change the equipment that people have,” O’Donnell said.

“There’s at least another good half a year and maybe a year in 2021 for growth in the PC market,” he predicted.

Rubin maintained that it’s going to be difficult for manufacturers to match the “comparables” — one year compared to another — when 2021 is stacked up to 2020.

“With such a high percentage of people upgrading, it’s going to be tough to keep up that level of growth in 2021,” he said. “The first quarter might not look bad because the pandemic didn’t hit until the second quarter, but by the third quarter, comparisons will be much lower.”

Comparing 2021 to 2020, though, may not be the best way to judge performance for the year, maintained Baker.

“If you compare 2021 to 2020, PCs will probably be negative, but you’re comparing an historic peak that broke a trend line,” he said. “If you compare 2021 to 2019, a more normal year, what you’ll see is a good solid high-single digit or double-digit growth.”