For many in the pay-TV industry, Netflix was the first wake-up call that a new-generation of online or technology companies could have a significant impact on their pay-TV business.

Over a 10-year period, Netflix grew from a U.S.-only DVD-by-mail service to a force in the international video entertainment industry. Netflix’s service is available in more than 190 countries, and it has approximately 149 million subscribers worldwide.

YouTube, which launched in 2005 — just before Netflix began streaming videos to consumers — quickly grew to become one of the world’s most popular video websites, changing video consumption and the advertising industry as it grew.

Online giants including Facebook, Twitter and Amazon increasingly have been seeking opportunities to expand into video entertainment in order to grow their businesses globally. These three companies now broadcast live sporting events, content that has been a mainstay for broadcast and pay-TV.

Google and Hulu offer their own online pay-TV services in the U.S., moving from potential pay-TV threats to direct competitors.

Assessing the Data

Executives of tier 1 pay-TV providers around the world have observed this shift with increasing alarm. In the U.S. market, the emergence of these companies has coincided with shifting consumption habits, regularly poor NPS scores, and a fall in pay-TV subscribers across the market.

The result has been an examination of what these companies have been doing to achieve their growth. Effective data use and analysis are a fundamental component of their success.

Netflix, Amazon, Google and Hulu each measure the volume of video user data collected in terms of billions of events and multiple petabytes (PB) of data per day (one petabyte is equivalent to one million gigabytes). These and other new-generation companies have invested heavily in research talent to assess this data as well as technology innovations to create the tools to leverage it effectively.

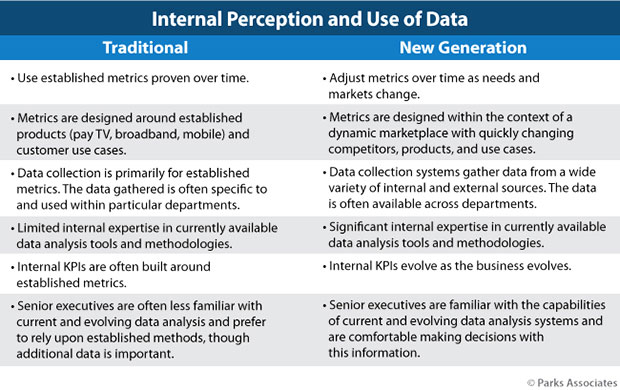

However, the answer for operators involves more than just hiring data experts and forming a new division. Several differences exist between traditional pay-TV providers and the new-generation of companies in their approach to data and business metrics.

Overall, the difference in attitude and approach underscores the cultural differences among these types of organizations, which are difficult for most pay-TV providers to overcome.

Competing Developer Approaches

Cable and telco providers have built their businesses and practices over many decades, making it difficult to drive organizational change at the pace common to companies in the online or technology sectors.

For years, the pursuit of high-quality services and five-nines reliability has biased these organizations to prioritize stability over change. The popularity of online video and the need to adapt has disrupted that approach, forcing today’s pay-TV providers to ramp up innovation while simultaneously preserving quality and reliability — a difficult task.

Beyond differences in approach and culture, traditional pay-TV providers and new-generation entertainment and advertising companies have unique advantages and challenges related to data use.

Traditional and new-generation entertainment companies differ significantly in software development and the use of data in the development process. As the pay-TV industry has evolved, software development capabilities have become increasingly important for ongoing competitiveness.

Tier 1 operators now have extensive in-house development teams and drive areas of innovation for the entire industry. Smaller operators often rely on technology vendors to perform development.

Historically, an operator’s internal teams developed software involving major releases that were created and tested over a long period of time (with a quick cycle taking six months or more).

Vendor-based development worked similarly, with vendors creating software based on client specifications and delivering it when it was complete and tested. Over time, operators have sought ways to shorten this cycle, from months to weeks or days, in order to operate more like technology firms and launch new features ahead of competitors.

In contrast, many of the large technology companies in the entertainment and advertising spaces began with software development as a core part of their business. As a result, the entire organization is driven around rapid development practices that measure progress in weeks and days rather than in months.

Development approaches such as Agile, which prioritize continual improvement and cross-functional teams, benefit from data use and analysis providing quick feedback that can be used to test and iterate software.

Cultural Shift

Content creators have unique challenges compared to their traditional pay-TV distribution partners. Historically, while pay-TV providers had ample data on video consumption, content producers, cable networks and broadcasters had limited data beyond Nielsen and third-party estimates of viewing volume and demographics.

This lack of information helped drive interest in TV Everywhere features, catch-up viewing apps, and direct-to-consumer OTT video services.

Another challenge is the opposition to data-driven decisions within the organization. Business leaders within content creators are eager to use data to help validate project funding and minimize investment risk, particularly as budgets for film and television increase.

However, the creative departments may perceive data-oriented information as something that will attempt to inhibit their creativity. The creative departments want to push the boundaries of creativity, and fear that data use within the organization will limit project investment to items of predictable value rather than projects that are artistic, edgy and new.

As changes in the pay-TV industry continue to disrupt traditional providers, organizations will begin to incrementally establish a new data-centric culture. In large, established organizations, cultural changes are some of the most difficult to implement.

The bottom line is that operators need to begin now, knowing that changes will take years to accomplish. Companies must begin with specific goals and objectives in mind, with appropriate expectations of results and timing. The strategy needs to be top-down, with commitments of executive management driving the change.

Social CRM

See all Social CRM