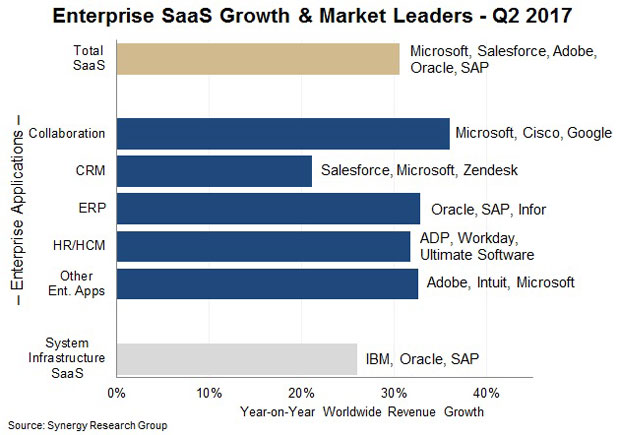

The enterprise Software as a Service market grew 31 percent year over year, totaling almost US$15 billion in revenue in Q2 2017, according to Synergy Research. Collaboration was the highest growth segment.

Microsoft is the clear leader in overall enterprise SaaS revenues, having overtaken Salesforce a year ago. Microsoft’s acquisition last year of LinkedIn gave its SaaS operations a significant boost.

“Across its whole business, Microsoft has a good cloud-oriented vision in place and is executing strongly,” said John Dinsdale, chief analyst at Synergy Research.

Salesforce came second in terms of overall revenue, followed by Adobe, Oracle and SAP.

However, Oracle, Microsoft and Google are the SaaS vendors that achieved the highest overall growth, Synergy found.

Many Vendors, Many SaaS Visions

The SaaS market is fragmented, with different vendors leading each segment:

- Microsoft, Cisco and Google lead in the collaboration market;

- Salesforce, Microsoft and Zendesk head the customer relationship management market;

- Oracle, SAP and Infor lead the enterprise resource planning market;

- ADP, Workday, and Ultimate Software lead the human resources/human capital management market;

- Adobe, Intuit and Microsoft lead in other enterprise apps; and

- IBM, Oracle and SAP lead in system infrastructure SaaS.

“While it’s a fragmented market, we’ll continue to see new market entrants offering innovations,” noted Rebecca Wettemann, research director at Nucleus Research.

There will be a certain amount of market consolidation, with the major players continuing to acquire smaller and mid-sized ones, Synergy’s Dinsdale told CRM Buyer, “but there will continue to be a constant stream of startups and small players entering the market.”

The larger vendors will try to buy companies with cloud revenues in order to increase their valuation and add multiples of existing revenue, suggested Ray Wang, CEO of Constellation Research. Meanwhile, they’ll build out their footprints for functionality, an ecosystem of partners, and marketplaces for customers.

The ability of upstarts to offer freemium and other offerings “means barriers to entry are relatively low, and even for established players, customers are up for grabs every time renewals come around,” Nucleus Research’s Wettemann told CRM Buyer, “so, it’s everyone’s market to lose.”

SaaS vendors “have to resell their customers every time renewal comes around, which certainly keeps things interesting,” she said.

Hope for Future Growth

Spending on SaaS remains relatively small compared to spending on on-premises software, which means SaaS has room to grow, according to Synergy.

The SaaS market will double in size over the next three years, showing strong growth across all segments and all geographic regions, the firm predicted.

Traditional enterprise software vendors like Microsoft, IBM, SAP and Oracle have a huge base of on-premises customers they are pushing aggressively to convert to SaaS.

Meanwhile, cloud-based software vendors like Zendesk, Workday and ServiceNow also are pushing enterprise spending on SaaS.

Microsoft will remain a major player, Synergy’s Dinsdale suggested.

“Given the huge base of on-premises customers [Microsoft] has under its belt, it can hardly fail to continue aggressively growing its SaaS business years into the future as it moves those customers onto a subscription-business model,” he said.

Another Perspective

Synergy’s rankings are valid when apps like Office 365, Yammer, LinkedIn and Skype are included, observed Constellation’s Wang.

However, “most folks would exclude that software as enterprise software in the traditional sense,” he argued.

A traditional approach to enterprise software rankings likely would put Salesforce in first place, followed by Oracle, SAP, Microsoft, ADP, Workday and Service Now, Wang told CRM Buyer.

Who’s Buying Into SaaS?

Software vendors are going the SaaS route to improve their standing in the market.

Growth in enterprise spending on hosting and cloud services will outpace growth in overall IT spending, 451 Research has found.

Software vendors don’t need to offer products that span many of the major application areas, Synergy’s Dinsdale said. “There will still be plenty of room for success for those that have a careful focus.”

Social CRM

See all Social CRM