Sage is getting ready to enhance its mobile payments offerings. Next month, the company will roll out Sage Exchange.com, an interface for Sage Exchange, which it introduced two years ago.

The rollout of Sage Exchange.com will considerably enhance what Sage Exchange offers customers, Greg Hammermaster, president of Sage Payment Solutions, told CRM Buyer. “Sage Exchange two years ago is a platform that enables fundamental data integration among the accounting, accounts receivables and other elements within a company.”

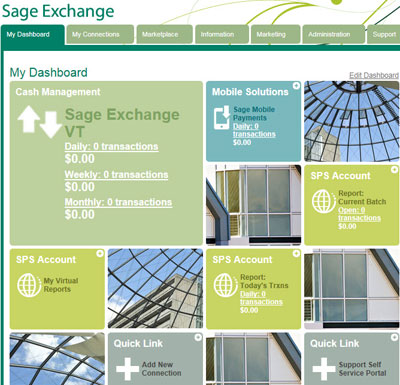

Sage Exchange.com will be a user interface or portal to that data integration, he said — an interface that will be able to connect to point of sales devices such as credit card terminals or mobile phones.

“It will be a comprehensive payment management portfolio that will offer a step-by-step approach to connect to a POS device,” he noted.

Payment Clearinghouse

In May, Sage also will upgrade Sage Mobile Payments to include invoicing and other new features, Hammermaster said. However, he called the Sage Exchange.com rollout the centerpiece of the company’s forthcoming mobile payment system upgrades.

Sage Exchange.com will connect users to just about any payment mechanism at the point of sale, Hammermaster said. “That includes POS terminals, mobile devices that take payments, check readers, ACH transfers — anything that takes a customer’s payment.”

With a connection to Sage Exchange, payment data can flow seamlessly through a company’s accounting system in real time, he said.

Because it is Web-based, no additional IT resources are required to integrate Sage Exchange.com to Sage Exchange.

“Any non-tech person can set it up and log on,” said Hammermaster.

Soup-to-Nuts System for SMBs

There are other features accompanying Sage Exchange.com as well — features that will make the system a “soups-to-nuts enterprise level managed payments environment for a small business,” Hammermaster said.

“The business owner will be able to log in and see all of the various payment devices at all of the franchises or store locations at which they are located,” he said, and will be able to run reports from that data, perform back office administrative functions with the system, and even churn out marketing-related offers.

“For example, a business will be able to offer a custom coupon printed on a credit card receipt via a special POS terminal that we sell at Sage,” Hammermaster said.

The SMB Market

These features clearly illustrate a strategic decision Sage made about its payments offerings, he added — that is, it decided it would not go after the consumer mobile payments market — an emerging and lucrative space, but one that Sage felt was already crowded with competition.

“Where we have focused is on delivering an industrial-strength solution that has data integration capability for the small business,” Hammermaster said.

Social CRM

See all Social CRM