CRM has become big enough to generate a significant shadow. When an idea like putting customers in the center of our universe takes hold, we see ripple effects everywhere in the culture. Nobody wants to be in favor of something else.

But other times, CRM gets blowback from new trends. Such is the case with the ongoing Great Resignation in which millions of people have begun singing the old Johnny Paycheck tune, “Take This Job and Shove It.”

It’s a thing. The media is covering it with solemnity on the evening news asking implicitly what’s wrong with us, turning down work?

We’re supposed to be the hard-working get-ahead meritocracy. We work more hours annually than our counterparts in the developed world with their five or more weeks of vacation. But now this. People want to spend more time with…fill in the blank. How to explain it? What does it mean for CRM?

You might think that this is a passing fad because people need to pay their bills eventually. But early data that I’m looking at suggests more trouble than you might think and yet another new role for CRM.

The Great Resignation might best be described as a two-headed monster that we’ve only seen from one perspective. We’ve seen millions of people declining to work at menial jobs — jobs that don’t have benefits and many of them on the lowest end of the pay scale — paying only enough to grant you admission to the working poor.

Fed Report

But now, no less an authority than the Federal Reserve is pointing out the other side of the monster. The higher end of the pay scale is also under pressure, and I think it’s a problem with a CRM theme.

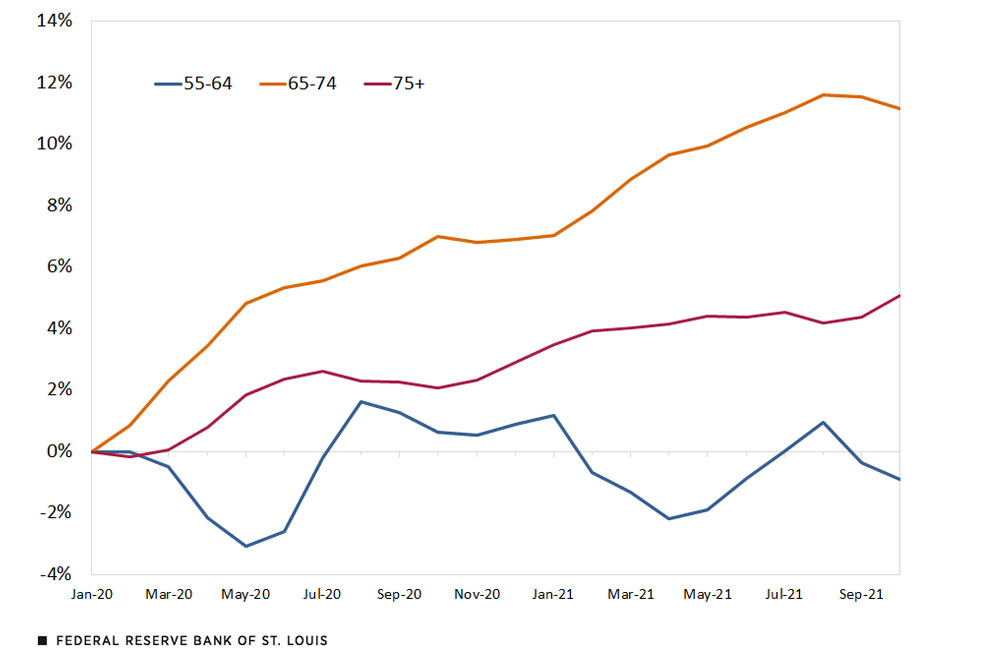

There’s a significant increase in retirements in the 65-to-74 age cohort — seven percent as of October 2021. This finding already takes into account the demographics of retirements for this group.

According to the St. Louis Fed’s latest report on the subject, “The rate of retirements exceeds that predicted by the demographic shift of baby boomers into retirement. This Great Retirement is a particularly important trend to understand as the nation is grappling with widespread labor shortages.”

Cumulative Percent Change in the Number of US Retirees Since January 2020

(Credit: Federal Reserve Bank of St. Louis, William M. Rodgers III and Lowell Ricketts)

In other words, we might have overlooked the idea that resignations can equate with retirements, the difference being retirees will likely never come back. The serious implication is that they’re taking their knowledge and experience with them. What’s left in place?

Well, for some companies it’s modern AI- and machine-learning driven systems. In many other cases it’s systems of record that people with knowledge and experience use to produce the functional equivalent of expert systems.

As long as the people remain, the difference to the business is small. Though systems of record run by smart people still operate more slowly.

A study I did over a year ago showed people in the latter group worked longer and harder to produce the equivalent result. But what happens when you remove the people?

Big Shoes To Fill

The Fed’s report slices the data well, showing that for today’s retirements males are less likely to retire than females, whites are more likely than other groups to keep working, and those with less than a college education are more likely than the college educated to retire. Also, the higher your household income, the less likely you are to retire.

But education at this end of the spectrum is less important because by the end of a career each of us is more likely to have acquired on the job educations that support more knowledge work in CRM.

Also, demographically, women are more likely to do knowledge work than men and more women are quitting. To my way of thinking this means the people with the most knowledge about how a business runs, and who actually do the work, are those most likely to be out the door.

If that’s so, it’s a CRM problem because it’s one that we may need to lean on CRM to fix. Since older people are the ones more likely to know how things work in a business, they’re the go-to authorities on the paper pathways running through most operations. When those people leave too quickly, they leave big, empty shoes.

Presumably, the retirement uptick can be partly managed by AI and machine learning, but this implies we have the data and the systems in place to make it all work. In many cases this may also mean people trained so that we can extract the critical information that suggests next best actions for less experienced people to pursue.

As I see it, the net is that we need more CRM, not less, and soon.

Social CRM

See all Social CRM