As many as a quarter of the world’s consumers were victimized by card fraud in the past five years, and financial institutions are losing customers as a result, suggests research conducted by payments software vendor ACI Worldwide.

ACI and the Aite Group, which jointly surveyed more than 6,100 customers equally divided by gender in 20 countries, also found that 23 percent of consumers hit by card fraud changed financial institutions because they were dissatisfied.

But dissatisfied with what? the financial institution? having been ripped off? or just dissatisfied in general?

That’s not quite clear, but “if a consumer experiences fraud and has to deal with a lot of red tape or gets the runaround on what is required to address the situation, a level of frustration is certainly going to set in,” Michael Grillo, a senior product marketing manager at ACI Worldwide, told CRM Buyer.

Poor quality — in products, services or customer service — and negative actions of employees are two of the top three harmful influences on an enterprise’s business reputation, noted Dun & Bradstreet.

More on the Study’s Findings

Debit, credit and prepaid cards all are susceptible to particular types of fraud.

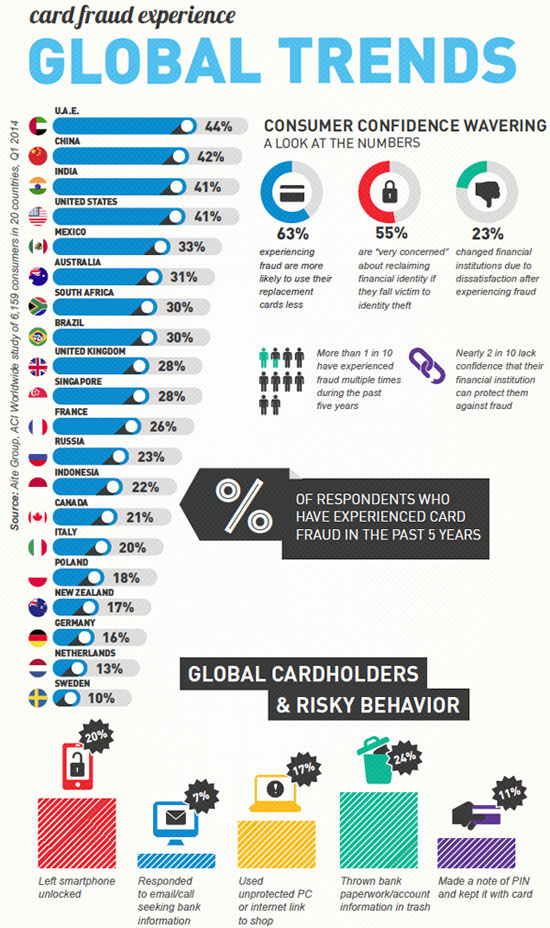

Fraud rates differ among countries. The United States is tied with India for third place, with a fraud rate of 41 percent. The United Arab Emirates led the pack with 44 percent, followed by China with 42 percent.

Sixty-three percent of fraud victims reduced their use of cards; 55 percent were “very concerned” about reclaiming their financial identity if their identities had been stolen; and more than 1 in 10 experienced fraud multiple times over the past five years, the study found.

Nearly one-fifth of respondents lacked confidence that their financial institution could protect them against fraud.

Oh, Squishy People

However, 50 percent of the respondents admitted to exhibiting at least one risky behavior that increased their risk of financial fraud.

Those risky behaviors included leaving a smartphone unlocked when not in use; responding to unsolicited email or calls seeking banking details; using online banking or shopping on the Internet without security software on their PCs, or doing so on a public computer; throwing papers or documents with account numbers in trash bins; and writing down and carrying their card PIN with them, Grillo said.

“It’s unfortunate that some consumers continue to exhibit risky behavior in the wake of all the efforts by financial institutions and retailers to make them aware of the consequences associated with these activities,” he added.

The Cost of Doing Business

“Financial institutions work hard and spend lots of marketing and sales dollars to get new — and retain existing — customer accounts,” Grillo said. “The impact of fraud can have serious implications to customer loyalty results and retention.”

Good brand recall causes a consumer to shut out alternatives when making a selection, leads to consumers picking that brand more often, makes for a clear and attractive brand image, and — combined with high customer satisfaction levels — bolsters customer loyalty, PMR Research said.

Brand recall when a consumer is hit by fraud has the opposite effect.

Still, consumers might be hard pressed to feel too sympathetic towards banks — bonuses paid out to financial industry executives this year exceeded the annual earnings of more than 1 million minimum-wage workers, according to the Institute for Policy Studies.

Something’s Gotta Give

“Consumers, banks and retailers all take a hit” when card fraud is committed, Grillo said.

The industry loses when fraud losses have to be absorbed or are offset by higher interest rates, fees and prices.

“For the most part, financial institutions have insurance and budgets set aside to remedy fraudulent activities,” Chris Rodriguez, a senior industry analyst at Frost & Sullivan told CRM Buyer.

Still, if card fraud continues and reaches a point that begins to deter enough customers, he said, “we may see more strict regulations and harsh penalties.”

Social CRM

See all Social CRM